|

|

Post by LFC on Oct 8, 2021 18:06:54 GMT

I suspect the solvency these two programs (i.e. need to pay back the "borrowed" trust fund in Social Security's case) will be more and more of a political issue as the percentage of retirees increases. While doing some research for work I stumbled into this analysis by the SSA from 2020 on how different changes to the program would impact the long-term solvency. I put a quick summary below of a few standpoints but there's loads of details and a summary graph for all of the methods analyzed. From the web page. From group E1 (increase payroll rate but keep the taxable wage maximum) these are the two that have a major impact. They carry the trust fund out to/past 2100.

Most of the provisions in group E2 (remove the wage ceiling and tax all earnings) add between 10 and 25 years to the solvency. A few don't do much and only add a few years.

Group E3 (keep the wage ceiling but increase it) seems to do very little with the best adding maybe 10 years and many barely moving the needle.

|

|

|

|

Post by LFC on Oct 8, 2021 18:16:47 GMT

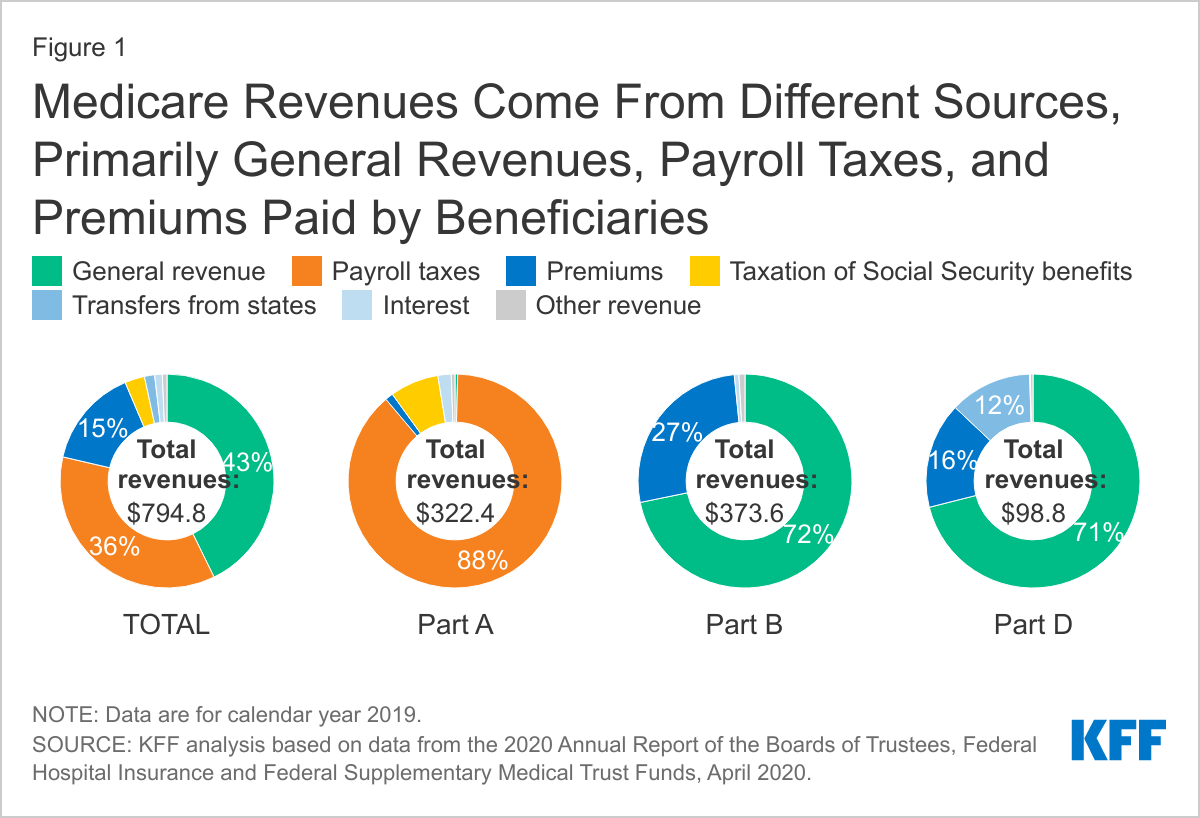

I'd like to make note of Medicare Part D in this graph. Note that the program that Republicans rammed through by having John Boehner suspend the House rules as Republicans openly bribed a Congressman on the floor is over 70% unfunded. It generates an annual cost from the General Fund of about $70B. Republicans never pay for any of their policies. Ever. All hail Jude Wanniski.

|

|

|

|

Post by LFC on Sept 2, 2022 20:23:58 GMT

RonJohn steps into it again. It's not necessarily a terrible idea to make it easier for retirees to pick up some work but, being somebody who has a track record of trying to destroy the social safety net, he's not exactly a good messenger.

|

|

|

|

Post by LFC on Oct 18, 2022 17:03:11 GMT

|

|

|

|

Post by LFC on Nov 3, 2022 14:55:26 GMT

After the failed push to privatize Social Security under George W it appears that Republicans are again preparing to dismantle it. Sure it's likely to be done by erosion but the ultimate goal is to destroy it. Sen. Mike Lee is saying it out loud, at least in what he sees as a friendly venue.

|

|

|

|

Post by LFC on Feb 22, 2023 19:10:27 GMT

Biden is not allowing Republicans to bury their positions on this topic under a pile of soft lies and denials, nor should he. It's both good policy and good politics. Here the latest swing. |

|

|

|

Post by LFC on Feb 22, 2023 19:12:12 GMT

|

|

|

|

Post by LFC on Feb 22, 2023 19:16:14 GMT

Republicans have long used the " we have to destroy it to save it" tactic.

Dems are, once again, proposing actual solutions. It's not like this is the first time but Republicans always fight these tooth and nail because they don't actually cut into the usefulness of the programs.

|

|

|

|

Post by LFC on Feb 23, 2023 16:54:40 GMT

Pence is all in on the destruction of the social safety net. Of course he's claim that he's trying to save it but there has yet to be a Republican plan that actually does so. They want cuts and privatization. And they definitely want to put off repaying the trust funds.

Whoa! That's a shock. Pence told the truth! It should be noted that Democrats created a compromise package that included multiple small adjustments. Republicans shot it down because it would have actually strengthened the programs rather than set up their destruction.

|

|

|

|

Post by goldenvalley on Feb 23, 2023 21:15:34 GMT

Pence is all in on the destruction of the social safety net. Of course he's claim that he's trying to save it but there has yet to be a Republican plan that actually does so. They want cuts and privatization. And they definitely want to put off repaying the trust funds.

Whoa! That's a shock. Pence told the truth! It should be noted that Democrats created a compromise package that included multiple small adjustments. Republicans shot it down because it would have actually strengthened the programs rather than set up their destruction.

It's 2005 all over again. Bush ran on a sort of culture war theme...gay marriage and abortion, the usual. When re-elected the first order of business was privatization of Social Security...let the people decide where to put their money...in the stock market in one way or another. |

|

|

|

Post by goldenvalley on Mar 7, 2023 22:08:55 GMT

|

|

pnwguy

Associate Professor

Posts: 1,447

|

Post by pnwguy on Mar 9, 2023 14:29:12 GMT

I say this as someone 64, but raising retirement ages to deal with the beneficial increase in human age seems valid. Most countries based their budgets from life expectancies that were far lower. There is no free lunch here, and we can't expect everyone in my daughter's age to carry an every increasing burden for the elderly. Besides that, none but the religious fundamentalists of all stripes are having the offspring that generations ago did, that made the ratios possible.

I expect to keep working into my 70s. But of course, I'm in software. I can understand the differences with jobs that are physically hard.

|

|

jackd

Assistant Professor

Posts: 813

|

Post by jackd on Mar 9, 2023 15:07:06 GMT

Raising taxes on the affluent will also do it.

|

|

|

|

Post by LFC on Mar 9, 2023 18:03:52 GMT

I say this as someone 64, but raising retirement ages to deal with the beneficial increase in human age seems valid. Speaking to the situation here in the U.S., we've already raised retirement ages. And keep in mind that much of the cited life expectancy increases since 1935 include the plummeting rate of childhood death due to vaccines. Those deaths dragged down earlier life expectancy averages, but these were people who neither paid into or took out of the programs.

Most countries also don't have the GDP per capita that the U.S. does, and most of those above it are tax havens like Bermuda, Luxembourg, Monaco, Singapore, Cayman Islands... Agreed that there's no free lunch but read the initial post. There are multiple ways to do this, with the best approach being some of this and some of that. In fact Obama and Boehner knocked out quite a bit of it. Of course Boehner immediately fell apart in front of his Tea Party pinheads and that was that. I actually have to look at these types of data points each year for my job. This is from the industry respected "EBRI RI/Greenwald Research Retirement Confidence Survey" for 2022 - Fact Sheet #2. So about 15% of workers already have to leave the workforce earlier than planned to to medical issues. Also 70% of workers believe they'll work some during retirement while the truth is that about 27% actually do. Some of that is for positive reasons but that's still a huge gap. I think that once you start talking about increasing the retirement age closer towards 70 you're pushing the ability for a lot of people to hold onto gainful employment. One final interesting data point is that Americans are claiming Social Security benefits later. Actuarially this should be a wash but I think it shows that people are already working later. |

|

AnBr

Associate Professor

Posts: 1,818

|

Post by AnBr on Mar 10, 2023 16:15:48 GMT

I was going to make many of the same points yesterday, but was on the go and then forgot. In addition to the point that life expectancy increases have been mostly from lowered infant mortality rates, of late expectancy has been dropping. Acknowledging more physically demanding jobs incapacitating the body earlier is one thing, but remember that it is not only the retiring iron worker that will experience physical and health issues, many white collar workers may have issues from more demanding jobs in their youth that will come back to haunt them. In your mid fifties if you get laid off you might find it hard to find employment in your old field as they often look only for younger, "dynamic" candidates. So many of these people have had to fall back on service sector jobs just to live. This happened en masse after the lock down. Initial improvements in unemployment rate data were skewed by many older workers that faced the grim employment prospects of menial labor opted to retire early instead. I would note that the SS cap has not kept pace with inflation. The contributions by the wealthy has been dropping over the years by this alone. Also so for many of the wealthy, the part of their income subject to the payroll tax is often just a small part of their actual income (capital gains, anyone?). Combine this with wage theft by the very same people and the shockingly growing inequality robs SS from the revenue that it would have had if wages had kept pace with inflation and increased productivity. And do I even have to mention how Repugs have been raiding the SS coffers only to not pay it back? Capitulating to the reich-wing narrative of how SS is just a ponzi scheme that is inevitably going broke and there is nothing that we can do about it is like buying into trickle down actually works. There are several non-radical proposals that would extend the solvency of SS by decades. Add to this forcing payback of the money stolen from the fund and addressing inequality extend it even further. We need to reexamine ALL of the false narratives pushed by the right that has framed our national dialog for decades and help push the Overton Window further and further to the right And there are many of them, all to twist the electorate's perspective on so many matters to fit the right's objective. |

|

pnwguy

Associate Professor

Posts: 1,447

|

Post by pnwguy on Mar 12, 2023 16:18:24 GMT

I think you are wrong about SS caps and inflation. I work with payroll systems and these are adjusted annually, based on the same CPI values that federal

tax withholding brackets are adjusted on. That was one benevolent thing that Congress passed years ago, to do this automatically, so that it didn’t have to be voted on every year.

It’s a shame that the Federal minimum wage law does have a similar adjustment.

|

|

|

|

Post by LFC on Mar 12, 2023 18:34:54 GMT

I think you are wrong about SS caps and inflation. I work with payroll systems and these are adjusted annually, based on the same CPI values that federal tax withholding brackets are adjusted on. Not quite. Social Security uses CPI-W (Urban Wage Earners and Clerical Workers). Until the 2017 Tax Cuts & Jobs Act, a multitude of federal income and estate values were indexed by CPI-U (All Urban Consumers), but now it is Chained CPI (C-CPI-U if I remember correctly). This has caused some differences in indexing but cumulatively over, say, the last 20 years I don't know how much and don't feel like digging through bls.gov though all the data is there. |

|